The roofing industry is experiencing unprecedented consolidation, with private equity firms and strategic buyers aggressively entering the market to acquire profitable, well-run roofing companies.

This creates a unique opportunity for business owners who are considering selling their business—but timing, presentation, and process are everything.

Selling your roofing business is a complex journey that requires careful navigation.

Drawing on our unique industry expertise gained from selling Reliant Roofing in 2021, we’ll walk you through every step of selling your roofing company so you can position your business to command premium offers in today’s seller-friendly market.

Table of Contents

Is Now the Right Time to Sell Your Roofing Business?

The roofing industry is currently experiencing a seller’s market, making it an ideal time to consider a sale for a few reasons:

- Private Equity Interest: The roofing sector is experiencing significant consolidation as private equity firms are actively investing in the roofing industry. This trend has created competitive bidding environments that can drive up valuations and sale prices.

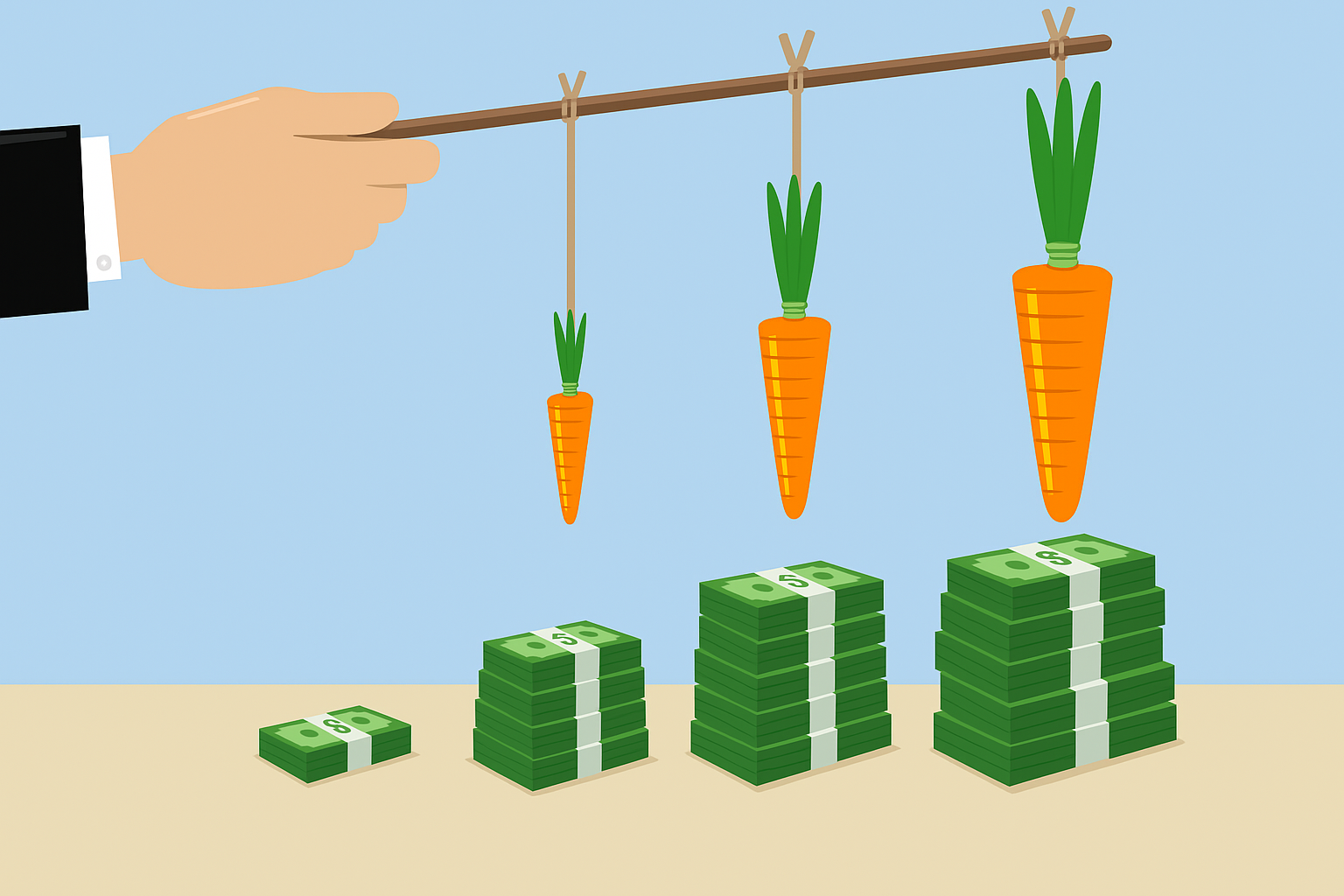

- Strong Valuation Multiples Buyers are currently willing to pay premium multiples for well-established roofing businesses with consistent revenue streams, experienced crews, and strong customer bases. This is particularly true for companies with a strong focus on residential services.

Hidden Risks of Waiting

While it might be tempting to wait for “the perfect moment,” delaying a sale can come with its own set of risks:

- Marketing Competition: If your competitors are acquired by private equity, their increased marketing budgets means they will likely be able to outspend you to acquire customers and take significant market share away from you.

- Labor Shortages: Finding and retaining skilled labor continues to be increasingly difficult due to the number of roofing technicians nearing retirement and changes in immigration policy. This could impact your business’s operational capacity and valuation.

Who Buys Roofing Companies (And Why It Matters)

The type of buyer you attract will significantly impact the sale terms, valuation, and even the future of your company. Understanding the motivations and criteria of different buyer types is key to positioning your business for a successful sale.

Private Equity Investors

Private equity (PE) firms have become major players in the roofing industry, driven by its fragmentation and growth potential. These private equity buyers are looking for businesses they can scale, often through add-on acquisitions or operational improvements.

Investment Criteria

- Profitability is critical: Generally PE firms are looking for trailing twelve month EBITDA to be at least $750k and they will pay around 5-8x multiple. Larger companies with EBITDA north of $2 million, may command a multiple closer to 7-9x.

- Diversified customer base: A large customer concentration is a negative for PE firms; they want to ensure your largest clients make up less than 10% of your overall revenue.

- Platform potential: If your business can serve as a foundation for acquiring smaller roofing companies, it will drive higher value and you will have more interested buyers. However, you will also need a more sophisticated management team to help with integration of add-ons, best practices, etc.

- New construction work: Little to no new construction work is preferred; it’s viewed as more cyclical and PE groups typically don’t like it.

- Insurance claim work: This is case by case, some PE groups love insurance focused companies and some will not even consider it.

Examples of Private Equity Buyers

New private equity roofing platforms are coming into the market weekly it seems but below are some of the biggest players from the previous years. Your M&A advisor will be the key to understanding what differentiates each of these players, what kind of acquisition they favor and how to best position yourself to attract interest from them.

Other Types of Buyers

Strategic buyers are often established roofing companies or businesses in related industries (e.g., construction, gutters, siding). They’re looking to expand their market share, geographic reach, or service offerings through acquisitions.

Another type of buyer is an individual sponsor, which are often local entrepreneurs looking for a turnkey opportunity to enter the roofing industry. While they have smaller budgets than private equity or strategic buyers, they are typically prepared to step in as an owner operator, which may be a better fit for smaller roofing companies with lower EBITDA and more owner dependence.

Why It Matters

The type of buyer you target will shape how you prepare and position your business. For example:

A PE firm will scrutinize your scalability and recurring revenue while an individual buyer might prioritize your reputation and customer relationships.

Understanding these motivations ensures you can tailor your sale strategy to attract the right buyer—and maximize your valuation.

The Step-by-Step Process to Sell Your Roofing Business

Selling your roofing business is a complex but rewarding process. To ensure a smooth transaction and maximize your company’s value, it’s essential to follow a structured step-by-step sales process.

Here’s a detailed breakdown of the key steps involved:

1. Initial Consultation

The first step in selling your roofing company begins with a crucial initial consultation with your chosen business broker or M&A advisor.

During this foundational meeting, we’ll discuss your goals for the sale, including your desired timeline and expectations. As your advisors, it’s crucial that we understand key aspects of your roofing business, such as your service areas, specializations (residential, commercial, or both), current workforce, and major contracts or relationships.

This meeting also serves to outline the entire sales process ahead, giving you a clear roadmap of what to expect and addressing any immediate concerns or questions you have about selling your roofing company.

If you are ready to learn more about your exit options, we invite you to schedule your initial consultation with Axia Advisors today.

Your Trusted M&A Advisors

Let us help you sell your roofing business with confidence and get the maximum value and best terms. Contact us today to start your exit assessment.

2. Confidentiality Agreement

The second step involves establishing a strong foundation of trust and privacy through a comprehensive confidentiality agreement. This legally binding document protects your roofing company’s sensitive information throughout the sales process.

The confidentiality agreement ensures that potential buyers cannot disclose any information about your business, including financial data, client lists, pricing structures, or your intention to sell.

This protection is essential to maintain business stability and prevent competitors from using the knowledge of your sale to their advantage. It also helps protect your relationships with employees, suppliers, and customers who might otherwise become uncertain about the company’s future.

3. Financial Analysis

The financial analysis phase is a comprehensive process that begins with gathering detailed documentation and transitions into a thorough evaluation of your roofing company’s financial health. Initially, your advisor will request:

1 Info Collection

Initially, your advisor will request:

- Three to five years of profit and loss statements

- Current balance sheets

- Tax returns

- Details of recurring contracts and maintenance agreements

- Equipment lease agreements and asset lists

- Job costing reports and project margins

- Sales pipeline information

- Accounts receivable and payable aging reports

2 Key Analysis Areas

Your advisor conducts a deep-dive analysis focusing on:

- Revenue patterns and growth trends (residential vs. commercial)

- Profit margins across service types (installations, repairs, maintenance)

- Operational costs, including labor and materials

- Seasonal performance variations

- Working capital requirements

- Outstanding liabilities and warranty obligations

This analysis helps identify your company’s financial strengths, such as strong profit margins or stable recurring maintenance contracts, as well as areas that might concern potential buyers, like high customer concentration or seasonal revenue fluctuations.

Having organized, accurate financial records is particularly important in the roofing industry, where project-based revenue, seasonal fluctuations, and equipment costs can significantly impact valuation.

4. Valuation and Strategy Development

Following the financial analysis, your advisor develops a preliminary market valuation and meets with you to review the findings and develop a strategic approach. This valuation considers key factors specific to the roofing industry:

- Historical and projected financial performance

- Size and quality of your customer base

- Market reputation and brand value

- Equipment and physical assets

- Quality of workforce and management team

- Geographic coverage and market position

During the strategy meeting, you’ll review the valuation drivers and potential detractors that impact how much your roofing company is worth. Together with your advisor, you’ll identify opportunities to enhance value before going to market.

This collaborative process ensures you understand your company’s current market position and have a clear plan to maximize its value during the sale process.

If you want to get an idea of your potential valuation before reaching out to us, we invite you to use our free valuation calculator below!

What's Your Roofing Company Worth?

Get an instant estimate of your company's market value with our free valuation calculator. PE firms are paying 5-9x EBITDA for quality roofing businesses in today's market.

5. Engagement Agreement

Once you decide to move forward with the sale, the process is formalized through an engagement agreement with your advisor.

This comprehensive document outlines the scope of services, timeline expectations, and communication protocols for the sale process. It clearly defines fee structures, payment terms, and the roles and responsibilities of each party involved.

The agreement also establishes key milestones, deliverables, and any exclusivity terms that may apply.

During this phase, your advisor will also begin assembling the initial team needed to support the transaction, which may include accountants, attorneys, and other necessary professionals familiar with roofing company acquisitions.

6. Information and Records Compilation

After formalizing the engagement, your advisor will provide a comprehensive list of required documentation needed to position your roofing company for sale.

This goes beyond financial records to include operational procedures, legal documentation, insurance details, employee information, client contracts, and vendor relationships.

Your advisor will work with you to gather this information systematically, ensuring minimal disruption to your daily operations. This documentation not only helps potential buyers understand your business thoroughly but also demonstrates a well-organized operation that commands premium value in the market.

The goal is to anticipate and address potential buyer concerns before they arise, streamlining the eventual due diligence process.

7. Confidential Information Memorandum (CIM) Development

The next phase begins with an in-depth interview to gather detailed insights about your roofing company. Your advisor will explore aspects of your business that go beyond the financial statements, such as your company’s history, competitive advantages, growth opportunities, and operational systems.

For a roofing company, this includes discussing your project management approach, crew capabilities, supplier relationships, and customer retention strategies.

Using this information, your advisor creates two key documents: a detailed Confidential Information Memorandum (CIM) and a brief teaser.

The CIM serves as a comprehensive marketing document that tells your company’s story, highlighting its strengths and growth potential.

The teaser, a concise anonymous summary, is used to gauge initial buyer interest without revealing your company’s identity. Only buyers who sign the confidentiality agreement receive access to the full CIM.

8. Market Engagement and Initial Interest

Once the marketing materials are ready, your advisor begins a carefully orchestrated process of reaching out to qualified potential buyers. The process maintains strict confidentiality throughout, with potential buyers initially receiving only the anonymous teaser document.

Your advisor will manage all preliminary buyer inquiries, qualifying their financial capability and strategic fit before revealing additional information.

As qualified buyers express interest and sign confidentiality agreements, they receive the comprehensive CIM and begin their preliminary evaluation of your business.

9. Indications of Interest (IOIs)

As potential buyers review your roofing company’s information, they submit non-binding Indications of Interest.

These preliminary offers outline their proposed purchase price, basic deal structure, and strategic rationale for the acquisition. Your advisor collects and evaluates these IOIs, analyzing each buyer’s financial capacity, industry experience, and likelihood of successfully completing the transaction.

During this phase, your advisor helps you compare different offers beyond just the purchase price. Key considerations include the buyer’s plans for your employees, their experience in the roofing industry, and their ability to maintain the relationships you’ve built with customers and suppliers.

Based on this evaluation, you’ll select the most promising buyers to move forward in the process and submit more detailed offers.

10. Letters of Intent (LOIs)

Selected buyers will submit formal Letters of Intent, which provide more detailed terms and conditions for the potential purchase of your roofing company. These documents outline specific elements such as:

- Purchase price

- Payment structure

- Transition period expectations

- Contingencies

Common considerations in roofing company acquisitions include handling ongoing warranties, treatment of equipment leases, and retention of key personnel.

Your advisor will help negotiate these terms with potential buyers, often working with multiple parties simultaneously to create competitive tension and secure the best possible terms. The goal is to select not just the highest offer, but the one that best aligns with your objectives and has the highest likelihood of closing successfully. Once you accept an LOI, you typically enter an exclusive negotiation period with that buyer.

11. Due Diligence Process

After accepting an LOI, the selected buyer begins a comprehensive examination of your roofing company. This detailed review typically involves verifying all aspects of the business that were presented in the CIM.

Your advisor coordinates this process, working with your CPA and other professionals to provide the necessary documentation while maintaining normal business operations.

During this phase, the buyer may request site visits, equipment inspections, key employee interviews, and detailed project records. The goal is to maintain momentum while ensuring the buyer receives the information needed to move forward confidently with the purchase.

12. Purchase Agreement Development

The Purchase Agreement phase transforms the accepted LOI terms into a detailed legal document that will govern the sale. The buyer’s attorney typically drafts the initial agreement, which is then reviewed by your legal counsel.

This document addresses specific aspects of selling a roofing company, including sale price, payment structure, assets included, considerations and other clauses.

Your advisor works closely with the attorneys to ensure the final agreement accurately reflects the negotiated terms while protecting your interests. This includes carefully structured provisions for any seller financing, earn-outs based on customer retention, and transition period responsibilities.

The focus is on creating a clear, comprehensive agreement that protects both parties and sets the stage for a successful closing.

13. Closing

The final phase of selling your roofing company involves executing the purchase agreement and completing all closing requirements.

This includes fulfilling any pre-closing conditions, such as obtaining necessary consents from landlords, key customers, or equipment lessors. Your advisor coordinates with all parties to ensure a smooth transfer of ownership, including the handling of final payments, transfer of licenses and permits, and execution of any employment or consulting agreements.

Special attention is paid to the timing of the announcement to employees, customers, and suppliers to ensure a smooth transition of relationships to the new owner. The closing process also includes detailed plans for transferring ongoing projects, warranty obligations, and customer contracts.

Your advisor helps manage these details to ensure a successful conclusion to the sale and a proper transition of your roofing company to its new ownership.

By following this step-by-step process, you can navigate the complexities of selling your roofing business with confidence. Each stage requires careful planning and execution, but with the right preparation and professional support, you can achieve a successful sale that rewards your hard work and sets your business up for continued growth under new ownership.

Key Parties Involved in Selling Your Roofing Business

Selling your roofing company isn’t a solo endeavor—it’s a team effort. To navigate the complexities of the sale process and maximize your business’s value, you’ll need to assemble a group of specialized professionals. Here’s a breakdown of the key players and their roles:

Roofing-Specialized M&A Advisors

M&A advisors who specialize in the roofing industry are your quarterbacks in this process. They understand the nuances of the market, know how to position your business, and can connect you with the right buyers.

Core Functions:

Valuation Expertise: They’ll provide you with a detailed assessment of your business’s value and help you determine a realistic asking price based on your financial data.

Buyer Identification: They’ll target the right buyers, whether it’s private equity firms, strategic buyers, or individual sponsors.

Deal Structuring: From negotiating terms to ensuring the deal aligns with your financial goals, they’ll handle the heavy lifting.

Benefits & Examples of Strategic Value Added:

Market Insights: They’ll provide data on recent transactions, helping you understand what buyers are willing to pay.

Efficiency: By streamlining the process, they can help you close the deal faster, minimizing disruptions to your operations.

Confidentiality Management: They’ll ensure your sale process is discreet, protecting your business relationships and employee morale.

Your Trusted M&A Advisors

Let us help you sell your roofing business with confidence and get the maximum value and best terms. Contact us today to start your exit assessment.

Legal & Tax Advisors for a Roofing Sale

Selling a business involves legal and tax complexities that can trip up even the most seasoned entrepreneurs. Having the right legal team on your side is crucial to avoid costly mistakes.

Critical Tasks:

Contract Review: They’ll ensure the purchase agreement protects your interests and includes key provisions like non-compete clauses and indemnification terms.

Tax Optimization: They’ll help structure the deal to minimize your tax liability, whether it’s through asset vs. stock sales or installment payments.

Compliance Checks: They’ll verify that your business meets all regulatory requirements.

Related Article

Legal Representation for a Roofing Company Sale

Expert legal counsel and M&A advisors play complementary roles when selling your roofing business. Learn how these professionals maximize value and minimize risk during your exit.

Read More →Financial Team Needed to Sell Your Roofing Business

Your financial team will play a pivotal role in presenting your business in the best possible light and ensuring you get the most out of the sale.

Team Composition:

- CPA: They’ll prepare your financial statements, ensuring they’re accurate and GAAP-compliant.

- Wealth Manager: They’ll help you plan for life after the sale, whether it’s reinvesting your proceeds or planning for retirement.

Key Deliverables:

- Financial Package: Working closely with your M&A advisor they will provide your financial documents, including profit and loss statements, balance sheets, and cash flow analysis.

- Tax Advice: They will provide guidance on tax implications of different deal structures.

- Post-Sale Plan: A strategy for managing your proceeds, including tax planning and investment advice.

Selling your roofing business is a significant financial event, and by assembling the right team, you’ll not only streamline the sale process but also position your roofing business for a successful and profitable transition.

They’ll not only help you maximize your value but also ensure the process is smooth, transparent, and aligned with your long-term goals.

Understanding Your Company's Market Value

Common Deal Structures in Private Equity Acquisition

The structure of your deal is almost as important as the sale price because it can take on so many different forms. Typically buyers don’t want to pay all cash to acquire a company.

Instead they want to figure out mechanisms to structure less cash at closing because they don’t need to raise as much capital or take on as much debt to acquire your company. Also the acquirer may want you to have some skin in the game to ensure that the business continues on the same positive trajectory after they purchase it.

The two most common deal structures we see in the roofing industry are earnouts and equity rollovers.

Earnouts

In an earnout, a percentage of your sale price will be contingent on hitting a specific milestone during a certain time period after the deal closes. For example you may sell your company for $10 million with a 30% 2-year earnout; where $3 million (30%) of the sale price is held for two years.

The milestone may be something like a 10% increase in EBITDA during the first year after purchase. If that milestone is accomplished in year one then 50% ($1.5 million) of the earnout is released to the seller, with the remaining half released after year 2.

Earnouts are typically 1-3 years but they may also be negotiated out of a deal sometimes.

Equity Roll-Over

In an equity rollover a percentage of your sale price will be required to be invested in shares of the platform company that is acquiring you.

This can often be a lucrative option for sellers. The goal for these private equity platform companies is to rollup multiple roofing companies, increase profitability and then sell the platform to a bigger private equity firm down the line for an even larger EBITDA multiplier.

Revisiting our previous example if your enterprise value is $10 million and your deal structure has a 10% equity rollover, at closing you would be required to reinvest $1 million into equity in the platform. In 3-5 years, if the platform company has been successful at growing the businesses, they should be able to sell it at much larger multiple in the range of 12-14x.

At this point your $1 million dollars worth of stock may now be valued north of $5 million dollars. This is known as the second bite of the apple.

When selling your roofing business, one of the most critical steps is determining its market value. This isn’t just about slapping a price tag on your company; it’s about understanding the financial frameworks, industry-specific drivers, and external factors that influence what buyers are willing to pay.

Let’s break it down.

Core Valuation Methods for Roofing Businesses

There are several ways to value a roofing business, and each method offers a different lens through which buyers might view your company.

EBITDA Multiples (5-8x range):

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is the gold standard for valuing operational performance. For lower middle market companies (EBITDA under $2 million) the average range of multiple you can expect is 5-8x.

SDE Adjustments (1.88-2.73x):

Seller Discretionary Earnings (SDE) is another common metric, particularly for smaller businesses (under $2M in revenue). It accounts for the owner’s compensation and benefits, giving potential buyers a clearer picture of the company’s financial health. If your business falls into this category, expect buyers to scrutinize your SDE closely.

Revenue Multiples (0.33x-0.86x):

This method is less common but can be useful, especially for businesses with thin profit margins. However, the multiple can vary widely based on how efficiently you’re converting revenue into profit.

Related Article

How Much Do Roofing Companies Sell For?

For roofing company owners contemplating an exit, understanding how to value a roofing company is critical to maximizing return on their life’s work ...

Read More →Roofing-Specific Value Drivers

Certain factors unique to the roofing industry can significantly impact your company’s valuation.

Weather-Resilient Markets:

Companies operating in regions prone to severe weather (like hail or wind storms) often fetch higher valuations because of the steady demand for roof repairs and replacements.

Service Mix Optimization:

Private equity platforms are looking to acquire roofing companies specializing in residential work. Therefore roofing businesses with a service mix focused on residential will typically get 1-2x more in EBITDA turns than those focused on commercial projects.

Technology Stack Impact:

Implementing modern tools like CRM systems (e.g., Acculynx or JobNimbus) can increase your company’s value significantly. Many platform buyers like to see that you’ve invested in technology that streamlines operations and improves customer service. For smaller add-ons, the buyer typically will have a preferred tech stack they like to implement upon acquisition.

Financial Health Indicators

Buyers will scrutinize your financials to assess the stability and predictability of your cash flow.

Profit Margin Benchmarks: Consistently hitting a net profit margin of 15% or higher qualifies your business for premium multiples. Buyers want to see that you’re not just generating revenue but also managing costs effectively.

Customer Concentration: If no single client accounts for more than 10% of your revenue, you’re in a good spot. Buyers are wary of businesses that are too dependent on a handful of customers.

Cash Flow Predictability: Providing three years of financials with less than 10% variance in revenue or profit can reassure buyers that your business is stable and predictable.

Backlog Analysis: A healthy backlog—typically at least a few weeks of consistent backlog —indicates a stable pipeline of work. This is a key metric buyers look for when assessing the future viability of your business.

Brand Equity Metrics: A strong online presence, like a 4.5+ Google rating, can add a premium to your valuation. Buyers are willing to pay more for a business with a solid reputation.

Workforce Valuation: A certified crew with a turnover rate below 10% is another strong selling point. Buyers want to know that the team they’re inheriting is skilled and reliable.

Understanding these valuation factors can help you position your roofing business for a successful sale. The key is to focus on the areas that matter most to buyers—whether that’s recurring revenue, a strong backlog, or a modern technology stack—and make sure your financials and operations are in top shape.

Cost Structure of Selling Your Roofing Business

Selling your roofing business isn’t just about the final sale price—it’s also about understanding the costs involved in the process. From professional fees to operational adjustments, here’s a breakdown of what you can expect to invest to ensure a smooth and profitable sale.

1. Professional Advisory Fees

Selling a business requires a team of experts, and their services come at a cost:

M&A Advisors: Typically charge 5-10% of the transaction value, depending on the size of your business and the complexity of the deal.

Legal Advisors: Expect to pay $40,000-$80,000 for legal services, including contract drafting, compliance checks, and liability reviews.

Tax Advisors: Tax structuring and planning can cost $10,000-$30,000, but this investment can save you significantly in capital gains taxes.

2. Operational Preparation Costs

Getting your business ready for sale often requires upfront investments:

Technology Upgrades: Implementing CRM systems like Acculynx or JobNimbus can cost $10,000-$30,000, but they add significant value to your business.

Compliance Audits: OSHA and environmental compliance reviews can cost $5,000-$15,000, depending on the scope.

Documentation Overhaul: Organizing financial records, SOPs, and contracts may require hiring temporary staff or consultants, costing $5,000-$20,000.

3. Marketing and Buyer Outreach

Attracting the right buyers involves strategic marketing efforts. If you work with an M&A advisor these services are included in their fee, however if you are selling your business without an advisor, these are the costs you will need to cover:

Confidential Information Memorandum (CIM): Creating a professional CIM can cost $5,000-$15,000.

Brokerage Fees: If you use a business broker, expect to pay 10-15% of the sale price for smaller deals or 5-10% for larger transactions.

Advertising: Targeted marketing campaigns to reach potential buyers can cost $2,000-$10,000.

4. Post-Sale Transition Costs

Ensuring a smooth handover often involves additional expenses like indemnity escrow.

When selling your roofing business, the indemnity escrow acts as a financial safety net for the buyer, protecting them against potential undisclosed liabilities or breaches of representations and warranties.

If nothing material comes to light within 12-18 months after the sale, the funds are released to the seller.

5. Hidden Costs to Watch For

Tax Implications: Capital gains taxes can take a significant bite out of your proceeds, so work closely with your tax advisor to minimize liabilities.

Opportunity Costs: The time and energy spent on the sale process may divert your focus from running the business, potentially impacting profitability.

Unforeseen Liabilities: Addressing unexpected issues like unresolved warranty claims or compliance violations can add to your costs.

Maximizing ROI on Sale Costs

While these expenses can add up, they’re often necessary to maximize your sale price. For example, investing in technology upgrades or compliance audits can significantly boost your business’s valuation.

The key is to work with experienced advisors who can help you balance costs with the potential return on investment.

By understanding the cost structure upfront, you can budget effectively and avoid surprises, ensuring a smoother and more profitable sale process.