Earnouts in Roofing Acquisitions: Key Factors for Success

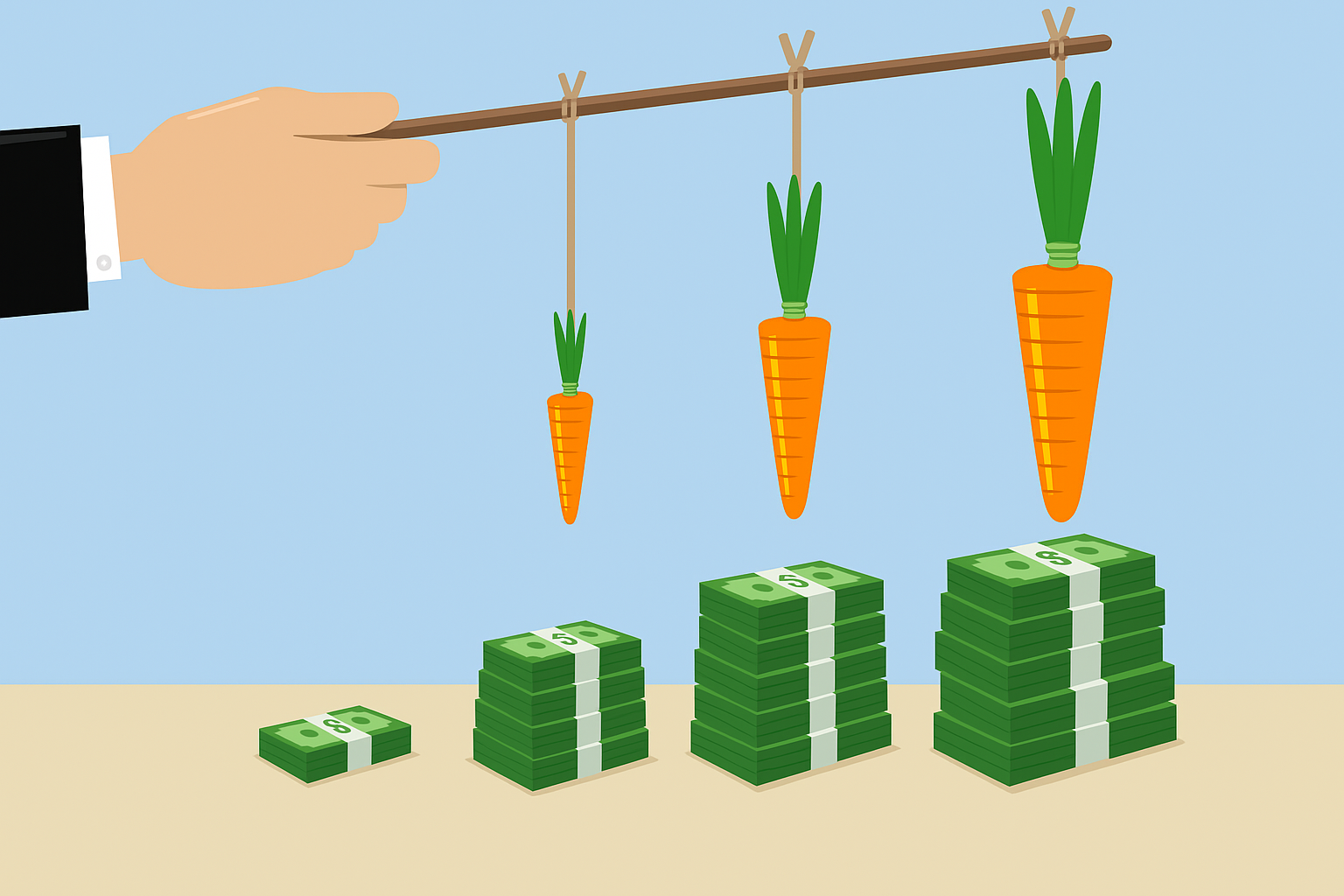

When roofing company owners and buyers sit down to negotiate a deal, one of the biggest challenges they face is agreeing on value. Sellers often believe their business is worth more than buyers are willing to pay upfront, especially when the company has strong growth potential or operates in seasonal markets with variable performance. This … Read more