When roofing company owners and buyers sit down to negotiate a deal, one of the biggest challenges they face is agreeing on value. Sellers often believe their business is worth more than buyers are willing to pay upfront, especially when the company has strong growth potential or operates in seasonal markets with variable performance.

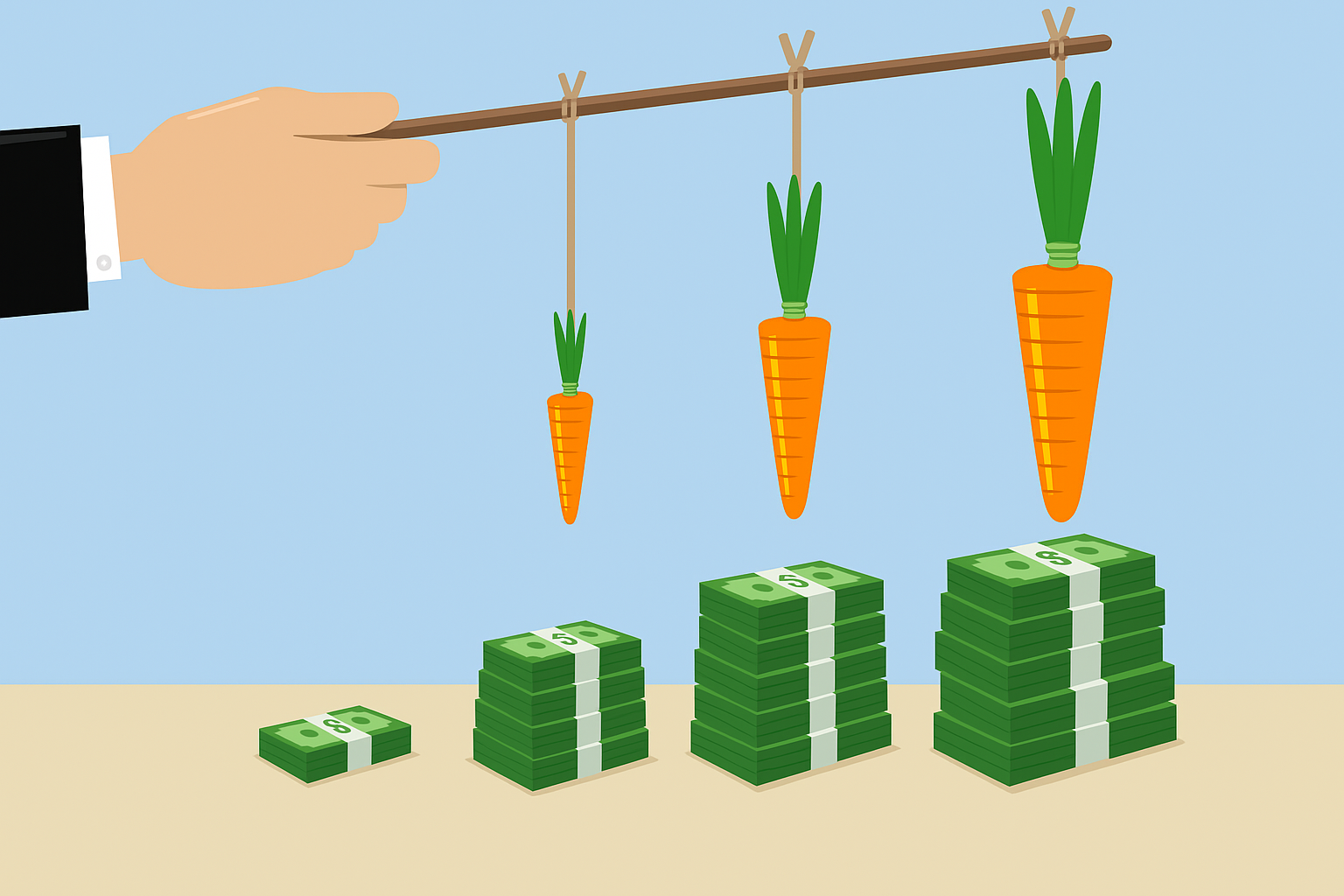

This is where earnouts become valuable tools in roofing mergers and acquisitions. An earnout allows buyers to pay additional money to sellers based on the company’s future performance after the sale closes. Instead of arguing over today’s value, both parties can agree that if the business hits certain targets, the seller will receive more money.

Key Insight

For roofing company owners considering a sale, understanding how earnouts work can mean the difference between leaving money on the table and maximizing the value of your life’s work. For buyers, well-structured earnouts can reduce risk while still allowing sellers to participate in future success.

Earnout Basics for Roofing Companies

An earnout is essentially a performance bonus built into the sale agreement. The buyer pays a base purchase price at closing, then agrees to pay additional amounts if the business achieves specific goals over a defined period, typically one to three years.

There are two main types of earnout structures used in roofing transactions:

Revenue-Based Earnouts:

- Pay sellers a percentage of sales above a certain threshold

- Example: 10% of any revenue above $5 million annually

- Simpler to calculate and harder to manipulate

- Don’t account for profitability or business quality

EBITDA-Based Earnouts:

- Focus on earnings before interest, taxes, depreciation, and amortization

- Better align seller interests with long-term business health

- Require more detailed accounting and clear expense definitions

- Can lead to disputes about what costs should be included

Typical Structure Parameters

Most roofing earnouts run for two to three years, giving enough time to see meaningful performance trends while not tying up the seller indefinitely. The earnout amount typically represents 10% to 40% of the total deal value, with higher percentages used when there’s significant disagreement about valuation or when the business has strong growth potential.

Roofing-Specific Challenges

Managing Seasonal Fluctuations

The most significant issue is seasonal revenue fluctuations. Most roofing work happens during favorable weather months, creating natural peaks and valleys in performance that have nothing to do with management effectiveness or business quality.

A well-designed roofing earnout must account for these seasonal patterns. Some agreements use rolling 12-month measurements instead of calendar years to smooth out seasonal variations. Others include weather adjustment provisions that modify targets based on objective weather data, such as the number of workable days or precipitation levels compared to historical averages.

The Storm Work Challenge

Storm work presents another major challenge. Hurricane, hail, or tornado damage can create massive revenue spikes that aren’t sustainable or predictable. Many earnouts exclude storm-related revenue entirely, focusing instead on base business performance. Others create separate targets for storm work, recognizing that a company’s ability to mobilize quickly and handle large insurance projects is a valuable skill.

Critical Consideration

Material Cost Impact

Material cost inflation has become increasingly important in recent years. Roofing materials can see dramatic price swings due to commodity costs, supply chain disruptions, or market conditions. Earnouts need provisions to handle situations where revenue grows but margins shrink due to material cost increases beyond the company’s control. Some agreements include material cost adjustment mechanisms that modify targets based on industry price indices.

Key Structural Elements

Establishing the Baseline

The foundation of any successful earnout is establishing a clear, fair baseline for measuring performance. This typically involves normalizing the company’s historical financial results to remove one-time items, unusual expenses, or seasonal distortions. The baseline becomes the starting point for measuring incremental performance during the earnout period.

Buyers and sellers must agree on exactly how metrics will be calculated. Critical questions that must be addressed include:

- Will revenue be measured on a cash or accrual basis?

- How will customer deposits and advance payments be treated?

- What happens to warranty work, callbacks, and customer satisfaction costs?

- Which expenses are included in EBITDA calculations?

- How are material cost fluctuations handled in margin calculations?

These details seem minor but can lead to major disputes later if not clearly defined upfront.

Management Control and Reporting

Management control during the earnout period requires careful balance. Sellers want assurance that the buyer won’t make decisions that undermine earnout achievement, while buyers need operational control of their new asset. Most agreements give buyers broad management authority while restricting specific actions that could harm earnout metrics, such as dramatically changing pricing strategies or cutting marketing budgets below agreed-upon levels.

Regular reporting keeps both parties informed and helps prevent disputes. Monthly or quarterly reports should detail earnout metric calculations, explain any unusual items, and project future performance. These reports create transparency and allow for early discussion of any issues.

Dispute Resolution

Dispute resolution mechanisms are essential because earnout disagreements are common. Many agreements require mediation before arbitration, giving parties a chance to resolve disputes without expensive legal proceedings. Some include expert determination clauses where an independent accounting firm resolves technical calculation disputes.

Best Practices

Choose Clear Metrics and Realistic Targets

Successful roofing earnouts start with clear, measurable metrics that both parties understand completely. Avoid complicated formulas or subjective measures that can be interpreted different ways. If you can’t explain the calculation method in plain English, it’s probably too complex.

Earnout targets should be challenging but achievable based on historical performance and realistic market assumptions. Targets that require 50% growth in a mature market are likely to fail and create animosity between buyer and seller. Consider the company’s growth trajectory, market conditions, and the resources the buyer will dedicate to the business.

Common Pitfalls to Avoid

Even well-intentioned earnouts can fail due to structural problems or unrealistic expectations. The most frequent mistakes include:

- Overly complex metrics that require extensive interpretation or specialized accounting knowledge

- Unrealistic growth targets that ignore market conditions, seasonal factors, or competitive dynamics

- Insufficient buyer investment in marketing, equipment, or staff during the earnout period

- Poor communication between management teams that leads to misunderstandings and conflicts

- Inadequate record-keeping that makes accurate metric calculation impossible or disputed

Align Incentives Properly

The best earnout structures reward sustainable, profitable growth rather than short-term metric manipulation. Revenue-based earnouts might encourage sellers to chase low-margin work, while profit-based earnouts could lead to cutting necessary investments. Communication throughout the earnout period prevents small issues from becoming major problems.

Consider Alternatives When Appropriate

When earnout structures become too complex or contentious, consider alternatives like seller financing with performance kickers, consulting agreements, or equity rollover arrangements that might achieve similar goals with less complexity and risk.

Case Study Example

A mid-sized commercial roofing contractor in Texas provides a good example of effective earnout structure. The company had $8 million in annual revenue but significant growth potential in an expanding market. The seller wanted $12 million while the buyer offered $9 million, creating a $3 million valuation gap.

They structured a deal with $9 million at closing plus an earnout that could pay up to $3 million over three years. The earnout was based 60% on revenue growth above $8.5 million annually and 40% on maintaining EBITDA margins above 12%. This structure encouraged growth while protecting profitability.

Key protective provisions included:

- Weather adjustments based on workable days compared to 10-year averages

- Exclusion of storm work above $500,000 annually

- Material cost adjustments tied to industry indices

- Guaranteed minimum marketing and equipment budgets

The earnout succeeded because both parties had realistic expectations, the metrics were clearly defined, and the buyer invested in growth initiatives including new equipment and expanded sales staff. The seller earned $2.4 million of the potential $3 million earnout, and both parties were satisfied with the outcome.

Success Factor

Important Takeaways

Earnouts can be powerful tools for bridging valuation gaps in roofing M&A transactions, but they require careful design and realistic expectations from both parties. The seasonal and weather-dependent nature of roofing businesses creates unique challenges that standard earnout structures may not address adequately.

Success depends on choosing appropriate metrics, setting achievable targets, maintaining clear communication, and aligning incentives for long-term business health rather than short-term metric manipulation. Buyers must commit to supporting the business during the earnout period, while sellers need to stay engaged and focused on sustainable growth.

Most importantly, both buyers and sellers should work with experienced M&A advisors who understand the roofing industry’s unique characteristics. The upfront investment in professional guidance typically pays for itself by avoiding costly disputes and structuring deals that work for everyone involved.

A well-designed earnout can turn a difficult negotiation into a win-win outcome, allowing sellers to maximize their company’s value while giving buyers the performance assurance they need to justify their investment.